A leading commercial insurer relied heavily on manual review of broker submissions for complex RFQs. Each submission required specialist expertise, making it difficult to review every request in detail. The process was time-consuming, inconsistent, and limited by human capacity.

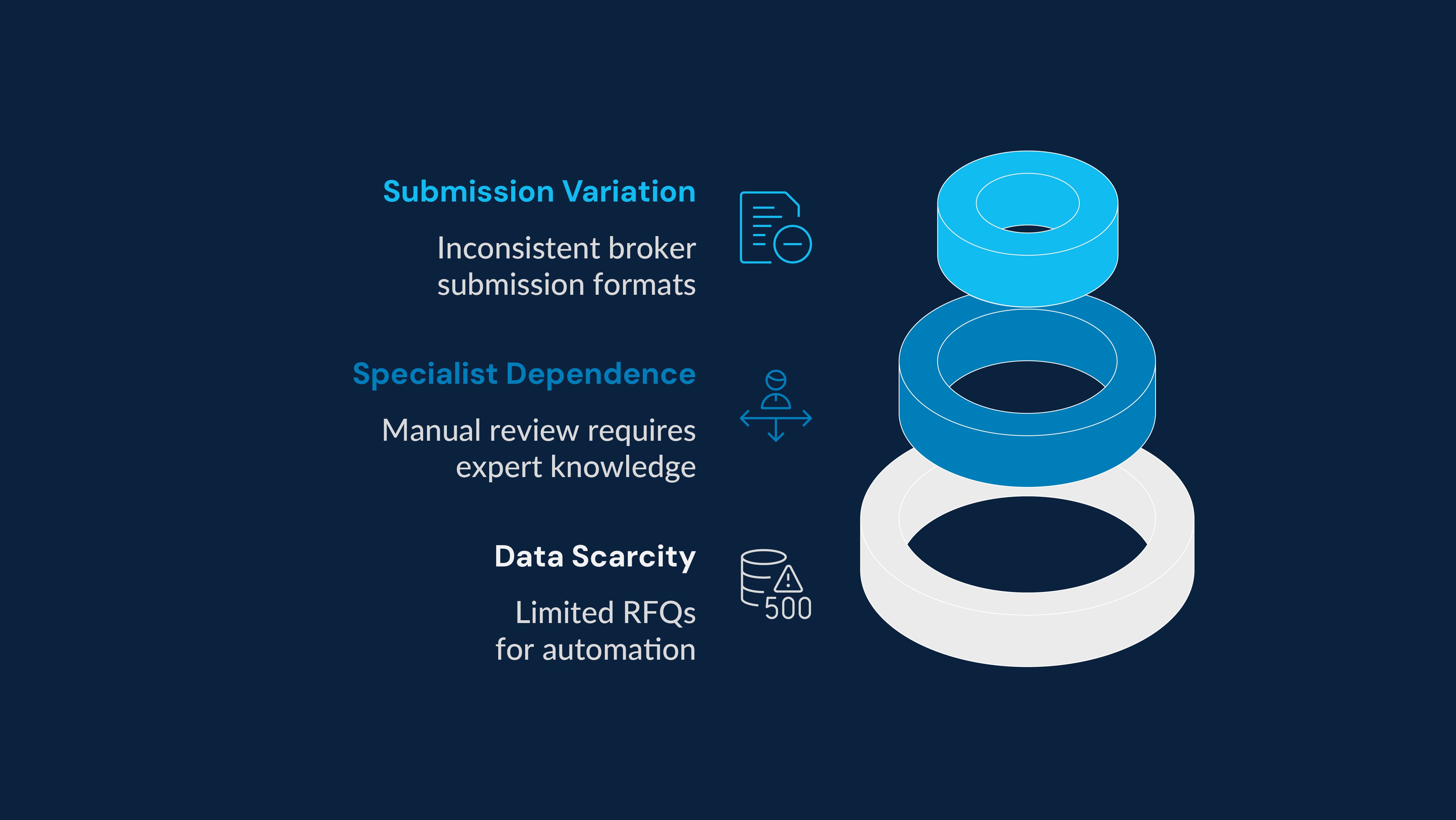

Key challenges

Fewer RFQs annually, with too little data for traditional automation methods.

The manual review process depended on specialist knowledge, limiting scalability.

Significant variation in broker submission phrasing and structure hindered standardization.

The solution

LLM-powered submission review

Validated and refined outputs.

Deployed LLM ingestion framework on the cloud.

Provided an interactive tool for testing and feedback.

Configurable and intelligent framework

Used RAG for fast large-document ingestion.

Enabled quick setup for new fields or formats.

Applied confidence scoring to flag uncertain results.

1

Collaborative development

Co-created solution with SMEs through iterative reviews.

Embedded feedback loops for continuous refinement.

2

Seamless deployment

Integrated within the cloud environment.

Ensured strong data security and compliance.

3

Continuous optimization

Monitored accuracy and performance metrics.

Updated configurations as submission formats evolved.

Business outcomes

High accuracy on unseen documents, cutting review time.

More small deals reviewed using freed-up capacity.

Maintained premium levels with notable COR gains.

Model performance

Tuned LLMs managed variation with limited samples.

Delivered consistent, high-quality extractions.

Scaled efficiently without losing accuracy.

Rapid improvement

Improved accuracy in a week.

Clear traceability of sources and prompts.

Continuous feedback accelerated optimization.