The recent COVID-19 global pandemic is sending shockwaves throughout the financial markets, the elasticity of consumer goods, and significantly impacting the way we engage in normal business activities, for the foreseeable future. As a result, financial institutions could see a run on cash, limiting their liquidity and restraining access to consumer credit – requiring retraining of credit risk models. This could also lead to a subsequent increase in delinquency rates and the likelihood of default across consumer lending – necessitating refresh of account servicing strategies. However, the most significant impact on financial institutions may be operational. Many retail banks are currently evaluating ways to minimize COVID-19’s impact on their day-to-day operations, testing BCPs (business continuity plans), implementing work from home (WFH) protocols, and investing heavily in digital transformation efforts to combat the disruption. As a result, competition amongst banks will be fierce, as consumers evaluate their banking options. Early adapters will gain a competitive advantage over that of slow adopters. Intelligent Automation (IA) solutions can assist organizations in successfully driving value throughout these challenging times, and amid the opportunities they present.

One of our core operating mantras is, “Don’t send a human to do what a machine can!” As per MarketWatch, the market for technological automation, such as robotic process automation (RPA), is growing at 20% per year and is likely to reach $5B by 2024. Intelligent automation leverages advanced technologies like data science and AI to make automation smarter and provide considerably more value to an organization. Over the next three years, polled executives estimate that intelligent automation efforts will drive an average cost reduction of > 20% with a corresponding increase in revenue of approximately 10%. The benefits of IA include speed and precision in operational productivity with reduced costs, greater accuracy, and improved customer experience. IA enables organizations to build bots that automate a critical business process that is highly repetitive for humans and provides an opportunity to refocus attention on strategy and innovation. With the growth in IA solutioning, FS executives expect automation to increase workforce capacity by > 25%, equivalent to over 2 million incremental FTE by 2023. Most financial services leaders agree they will reallocate the resource time saved in automation to higher-value work efforts that drive improvement to customer experience and organizational growth.

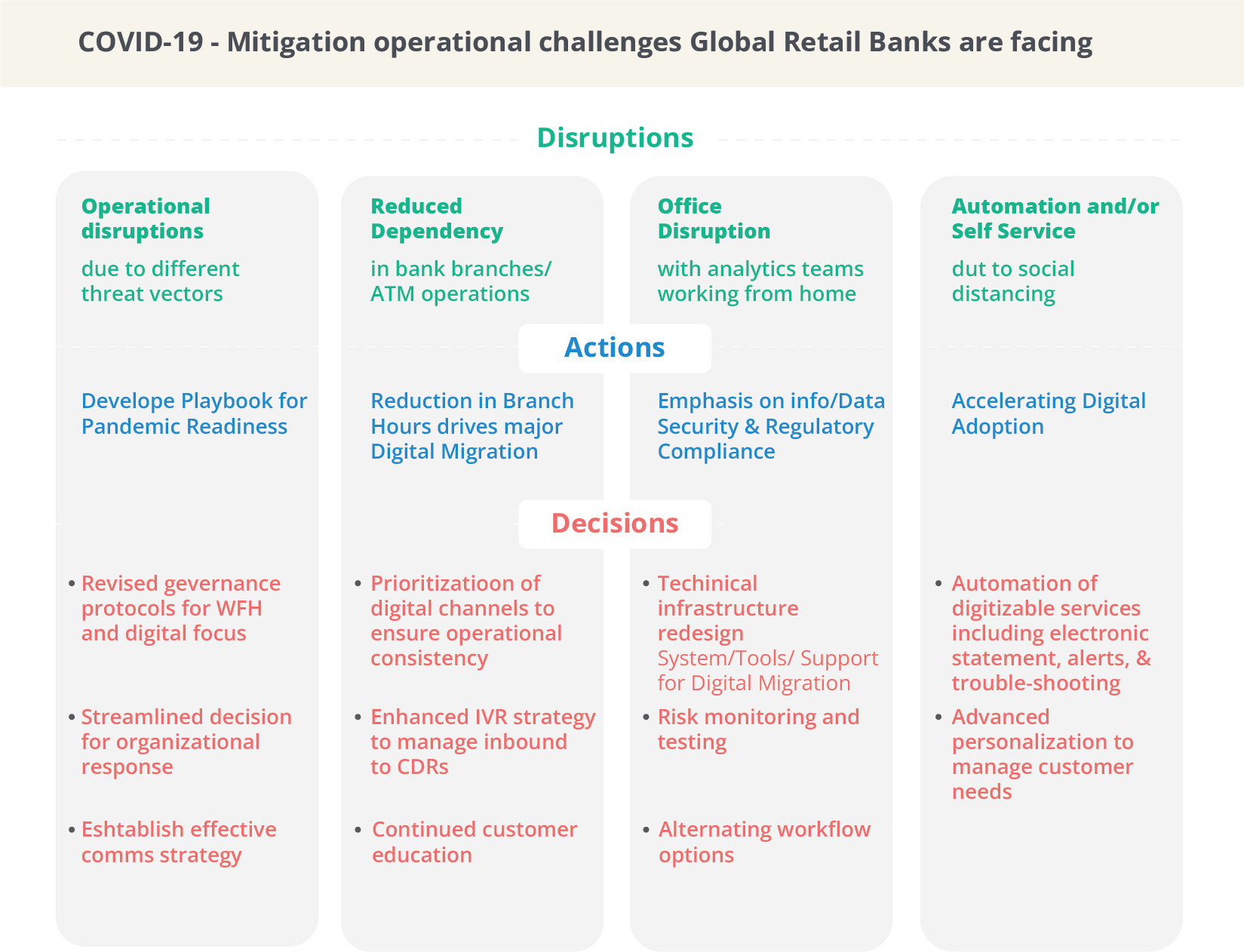

Let’s evaluate a few of the key operational disruptions to retail banks where IA can be applied:

The global nature of this recent pandemic highlights the need for retail banks to develop a playbook for readiness to deal with operational disruptors. To prepare, these institutions should be evaluating both data and operational governance protocols, as well as WFH (work from home) guidelines, to minimize disruption to employees. This playbook should include parameters for streamlined decision making for organizational response and developing an effective communications strategy for both employees and customers. These organizations should setup procedures and strategies to effectively prepare for a completedigital environment. A digital ecosystem where all customer sales and service journeys are handled via the web, app, and email methods. Also, organizations should review all BPO activities to evaluate opportunities for greater automation. AI and ML are essential mechanisms that can support banks in refining business operations during this massive digital migration. Once these opportunities are identified, intelligent automation can be effectively deployed to drive efficiency.

As the pandemic advances, the traffic and, therefore, reliance upon brick and mortar bank branches diminishes. Consequently, bank customers will remain at home, and we will see a substantial migration to digital channels for conducting banking activities

As the pandemic advances, the traffic and, therefore, reliance upon brick and mortar bank branches diminishes. Consequently, bank customers will remain at home, and we will see a substantial migration to digital channels for conducting banking activities. In response, retail banks will prioritize customer experience and hyper-personalization initiatives to ensure consistency in execution for customers who will migrate and likely to remain loyal on these digital platforms. Advanced personalization can be utilized to proactively direct customers to responsibly maintain and service their accounts. In addition, they will look to technical consulting and advanced analytics to remove all possible friction to these channels across both sales and servicing journeys, while identifying the root causes. Automated, AI-based solutions have been developed to overcome behavioral and data issues and drive digital insights by channel. However, there will always be those customers that are less technologically sophisticated and so data-driven enhancements to inbound CSR smart call routing, and self-service IVR strategies will be required. In the case of one large bank, we have seen digital activity only increase by 20%, while call center volumes have increase by 90% over one month. Lastly, FS institutions should be encouraged to dig deep into their data lakes during this surge in digital transactions across their web, mobile, IVR, and chat channels. That said, AI and ML can be useful tools to “weed through” data and in developing solutions to manage these unprecedented volumes and uncover actionable, strategic insights on changing customer behaviors.

As Operations teams are forced to work from home and required to seamlessly conduct business activities on behalf of customers, firms will need to perform digital analytics to effectively redesign their technical infrastructure in support of massive digital migration. This technical assessment will cover information/data security, network capacity, risk monitoring, and systemic tools. Subsequently, there is a significant opportunity to leverage intelligent automation in alert management and advanced monitoring of information security threats. IA marries standard RPA bots with AI / ML techniques that make bots more intelligent. A perfect example of where this could be leveraged is within retail banks KYC (Know Your Customer) automation.

Implemented correctly, automation of critical KYC processes, like customer identity verification and required documentation capture, frees up humans to apply reasoning and analysis. In many cases, this leads to better decisions and decreased risk. Another relevant use case might be integrating intelligent optical character recognition (OCR) with RPA to create a robust workflow for automating document-heavy processes such as invoices, contracts, and sales/purchase orders within accounting.

In a recent surveys of U.S. financial institutions, “less than 45% of retail banks and credit unions felt they had a high or very high degree of readiness in mobile technologies and digital platforming, with approximately 20% stating they had low or very low level of readiness.”

In a recent surveys of U.S. financial institutions, “less than 45% of retail banks and credit unions felt they had a high or very high degree of readiness in mobile technologies and digital platforming, with approximately 20% stating they had low or very low level of readiness.” Automation is key. There are numerous ways to accomplish this objective. The development of a digital roadmap focusing on all customer sales and service journeys will be a critical first step. These institutions should look to evaluate their utilization of automated assistants, IVRs, and bots and to the likelihood of increased traffic across those channels. Besides, there should be an investment to accelerate the adoption of digital servicing mechanisms, including electronic statements, self-service troubleshooting, and account maintenance. Intelligent automation within the customer response, alert notifications, and inbound query handling across email, web, and chat channel is critical.

A classic example is where banks are developing programs to provide automated responses to customer inquiries via emails. Typical business rules offer 20% coverage across standard queries, where the integration of more sophisticated AI can drive automated email response to over 60%. That’s a significant lift with the introduction of AI principles.

In the end, these are historically challenging times, and the COVID-19 global pandemic will fundamentally change how we work and engage with customers, now and into the future. The retail banks that will survive and thrive will be the ones that are able to react and adapt quickest to these environmental changes. Digital is at the epicenter of it all. Find some easy ways to get started with intelligent automation that can assist banks in improving business operations and customer experience. Now, as the new normal transpires, it is critical to address these opportunities.

Citations

- Global Market Insights, “To 2024, robotic process automation market to see 20% CAGR,” MarketWatch, October 5, 2018. https://www.marketwatch.com/press-release to-2024-robotic-process-automation-market-to-see-20-cagr-2018-10-05

- Deloitte Insights, 2019 Deloitte Global Human Capital Trends, 2019. https://www2.deloitte.com/content/dam/insights/us/articles/5136_HC-Trends-2019/DI_HC-Trends-2019.pdf

- Gartner, “How to Scale RPA and Achieve Business Value in Utilities”, April 2018

- Forrester, “RPA Operating Models Should Be Light and Federated”, Aug 2017

- Gartner, “How to Scale RPA and Achieve Business Value in Utilities”, April 2018

Authors