Franklin Templeton generates $600mn in new assets with Customer Genomics®

Company Background

Franklin Templeton Investments (FTI) is one of the world’s largest asset managers, selling mutual funds to investors through financial advisors (FA). One of FTI’s chief goals is to increase overall market share in an industry that is rapidly evolving with the demand for new products, a shift to fee-based business models, and more recently, the emergence of robo-advisors, and numerous regulatory changes. FA’s are challenged by this dynamic, highly competitive marketplace and have begun to adopt new digital channels to gain access to fund and market information. Engaging them meaningfully and serving their needs in this omni-channel world is critical to their retention.

The Challenge

In this changing competitive landscape, it’s imperative to influence the investment decision of the FA at the right time, with the right sales and marketing intervention, and with the right information for their business needs to grow FTI’s share of wallet. How do we better understand the behaviors, preferences, and needs of FA’s on a more personal level? How do we best communicate information about relevant products in the right message and channel? How can Franklin’s interactions with them provide maximum value, while simultaneously improving their level of digital engagement?

The Solution

To better serve the needs of its financial advisors, FTI partnered with Fractal to deeply understand FA’s by creating ‘Advisor Genomics®’ proprietary machine learning algorithms. This enabled Franklin to transform its digital strategy and increase the company’s ability to leverage analytics and machine-learning algorithms as a competitive advantage by increasing message relevance across all digital channels and providing actionable insights that add day-to-day value for sales and marketing engagement with FA’s.

Advisor Genomics leverages machine-learning and pattern-matching algorithms to develop a comprehensive understanding of FA’s by using granular historical data to generate an output set of personalized ‘FA genomic labels.’ These labels are probabilistic scores indicative of future propensities to transact and interact, and are also self-learning and adaptive, updating every new data point in an automated manner.

Rather than rely on a traditional RFM segmentation-based framework, Advisor Genomics was developed with the belief that customers ‘are what they engage with, and how they react to those engagements.’ This deep and adaptive understanding enables hyper-contextual and personalized interactions with FA’s by delivering the right message through the right channel at the right time.

Fractal is a great partner that has helped us advance our analytics practice. They contributed a level of experience and expertise that allowed us to move much more quickly than we would have been able to do on our own.

– Jennifer Ball, SVP Global Product Marketing & Insights, Franklin Templeton Investments

The Results

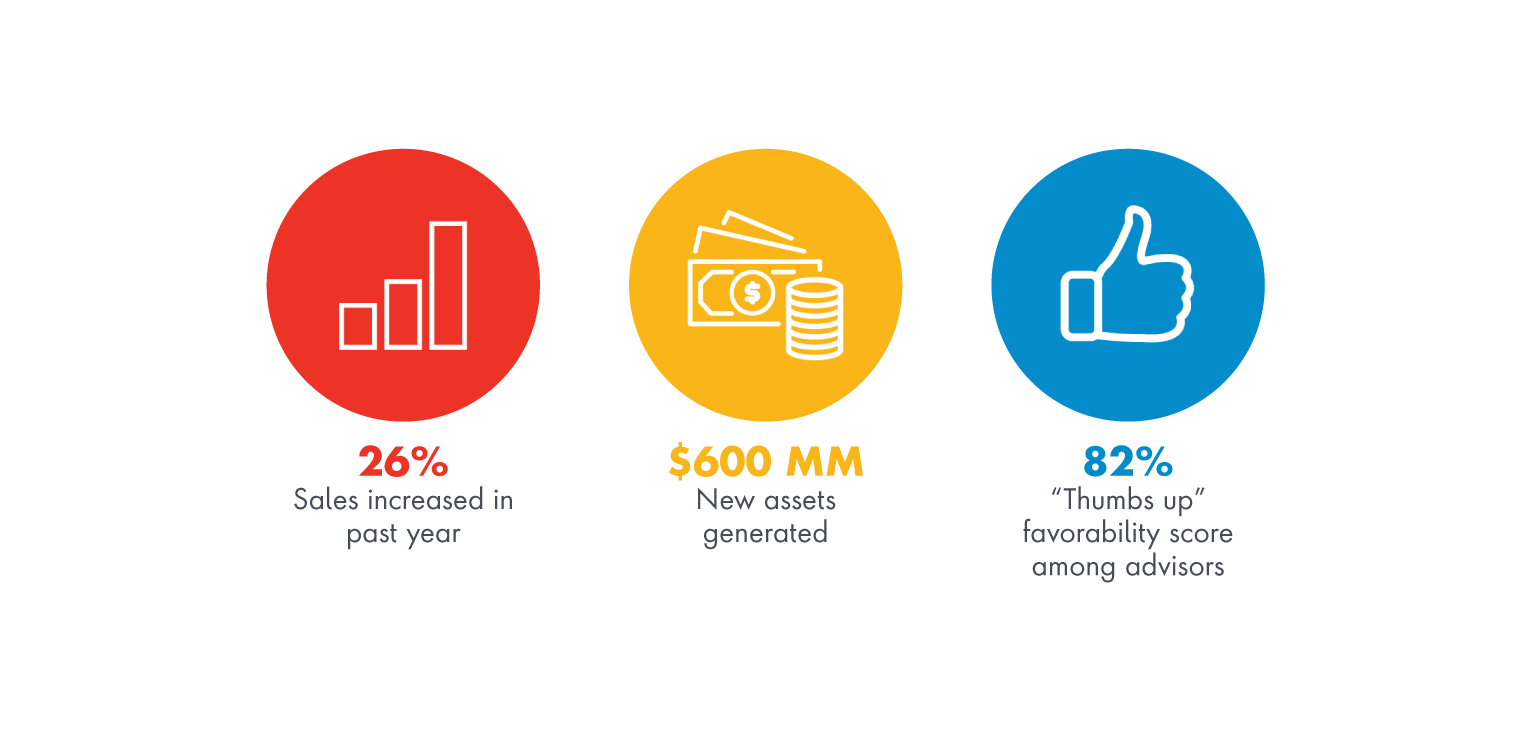

FTI’s ‘Advisor Genomics’ personalized behavioral and contact strategy system developed by Fractal Analytics resulted in:

Insights

- By combining customer genome predictions with product attribute matching, Fractal Analytics helped FTI profile potential advisors with laser precision so they could recommend the company’s products to their clients.

- Advisor Genomics identified additional leads to target for higher sales, as well as seasonal behavior in advisor purchases.

Innovation

- Advisor Genomics identified influencers within a specific firm who had the greatest potential to significantly increase sales.

- Advisors most likely to be active on social media channels were predicted and pro-actively engaged.

Impact

- Fractal identified 13.2K sales leads with a 65% success rate

- Insights generated 1,300 incremental leads that garnered $600 million in assets under management

This new marketing channel, combined with the new analysis and the analytics that we get from it, is really helping us expand our practice and reach clients that we wouldn’t have been able to reach otherwise.

– David McSpadden, Chief Marketing Officer

The Implementation

In order to establish a truly adaptive customer intelligence platform to meet FTI’s objectives, Fractal led the team to develop and implement the following protocol:

Harmonizing Data

- Integration of asynchronous data from various sources to enable the efficient measurement of sales impact of multi-channel interactions, including:

- Email campaigns data

- Web visits data

- Online simulation request data

- Social media data

- Event data

Understanding FA Behaviors

- Attributes were created for 350K advisors across the U.S.

- Measuring FA interactions across various digital channels

- Estimates were generated on the impact of multi-channel interactions on customer sales, transactions, and conversions

Optimizing FTI’s Interaction Strategy

- An optimum sequence of digital and non-digital interactions (calls, visits) were identified for each FA based on:

- Contact Strategy Genome Markers

- Channel Preference

- Channel Sequence

- Digital Engagement

- Message Response

- Optimal contact channels for sales interactions were established for 90K of the advisors

Ultimately, we are striving to really build and define and improve an ongoing conversation with our customers and really optimize and deepen our relationship with them.

– Kate Biagini, Manager, Analytics

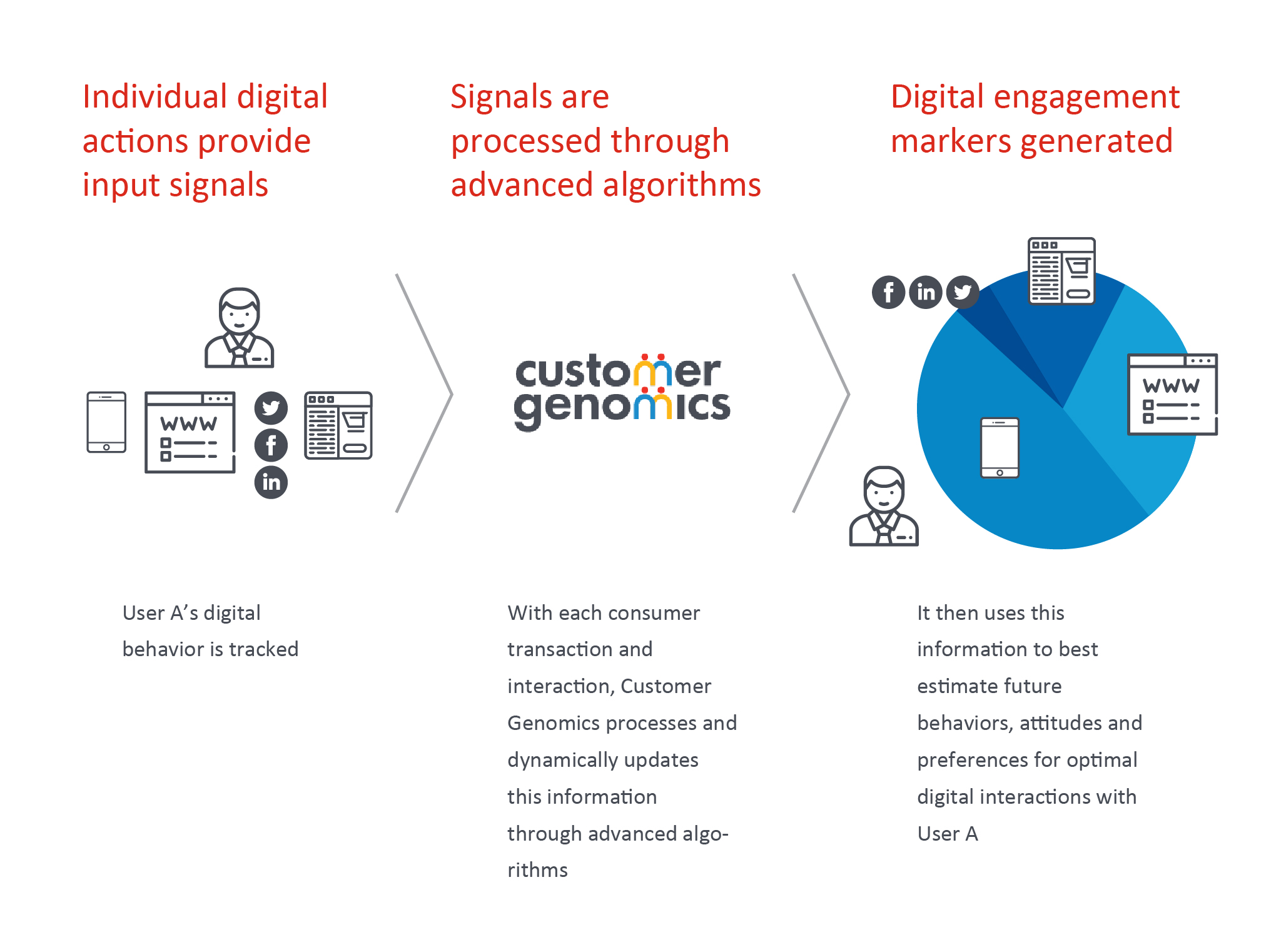

Customer Genomics ‘Genome Markers’ enable real time customer intelligence and engagement

Customer Genomics uses all available signals from each individual consumer across digital channels to build predictive artificial intelligence algorithms to create markers that predict the likelihood that specific consumer will respond to digital actions. This approach varies from traditional targeted segmentation in it’s ability to predict future behaviors, attitudes and preferences in an adaptive way where the models are automatically updated with each consumer action.

The Fractal team became an extension of our team. They are smart, collaborative and really fun to work with.

– Jennifer Ball, SVP Global Product Marketing & Insights, Franklin Templeton Investments

An interview with Jennifer Ball, SVP Global Product Marketing & Insights, Franklin Templeton Investments

Which strategic business objectives does analytics support for Franklin Templeton?

- At Franklin Templeton, our objective is to help investors achieve their goals with confidence so they can create a better future. Analytics plays a key role in helping us help our clients. For example, analytics helps us connect in a relevant way with the financial advisors who recommend our solutions.

What impact has analytics achieved in driving success for these objectives?

- We partnered with Fractal to implement an adaptive customer intelligence program called “Advisor Genomics” to transform our contact and digital marketing strategies. Genomics helps us determine which advisors to contact, how to contact them, and what to discuss.

Give us a peek under the hood of ‘Advisor Genomics.’ How does it actually work?

- The analogy to genomics works well as we are really trying to understand the business DNA of a financial advisor. We leverage machine learning and pattern matching algorithms on historical data to identify individual genome markers – from channel preferences and message response to purchase propensities, and the experience they have had with our solutions.

What actions are these ‘markers’ specifically used to drive or advance?

- We use these markers for lead generation, to identify relevant conversation topics for use by our sales force, and for our digital marketing efforts. Each activity and response feeds back into our models. The goal is to have an environment where sales and marketing are equipped to engage with financial advisors in a way that speaks directly to their preferences and needs.

What role has Fractal played in furthering your analytics goals?

- The work we did with Fractal was recognized by the ANA for the Genius Award in Digital Marketing Analytics. Fractal is a great partner that has helped us advance our analytics practice. They invested in learning our industry, our business, our company and our people. They contributed a level of analytics experience and expertise that allowed us to move much more quickly than we would have been able to do on our own.

What do you appreciate most about working with Fractal?

- The Fractal team became an extension of our team. They are smart, collaborative and really fun people to work with.