The pandemic has brought incredible anxiety & uncertainty for many banking customers. A limited call centre staff capacity and ongoing demand surge require an integrated strategy from inquiry–inception through resolution via assisted or non-assisted channels.

Industry estimates suggest that call volumes* in the EU will stabilize at 16% higher than pre-COVID. Many such calls will represent acute financial distress & complications. This complexity has led Average Handling Time** to jump 3x to about 10min and significantly higher call abandonment rates.

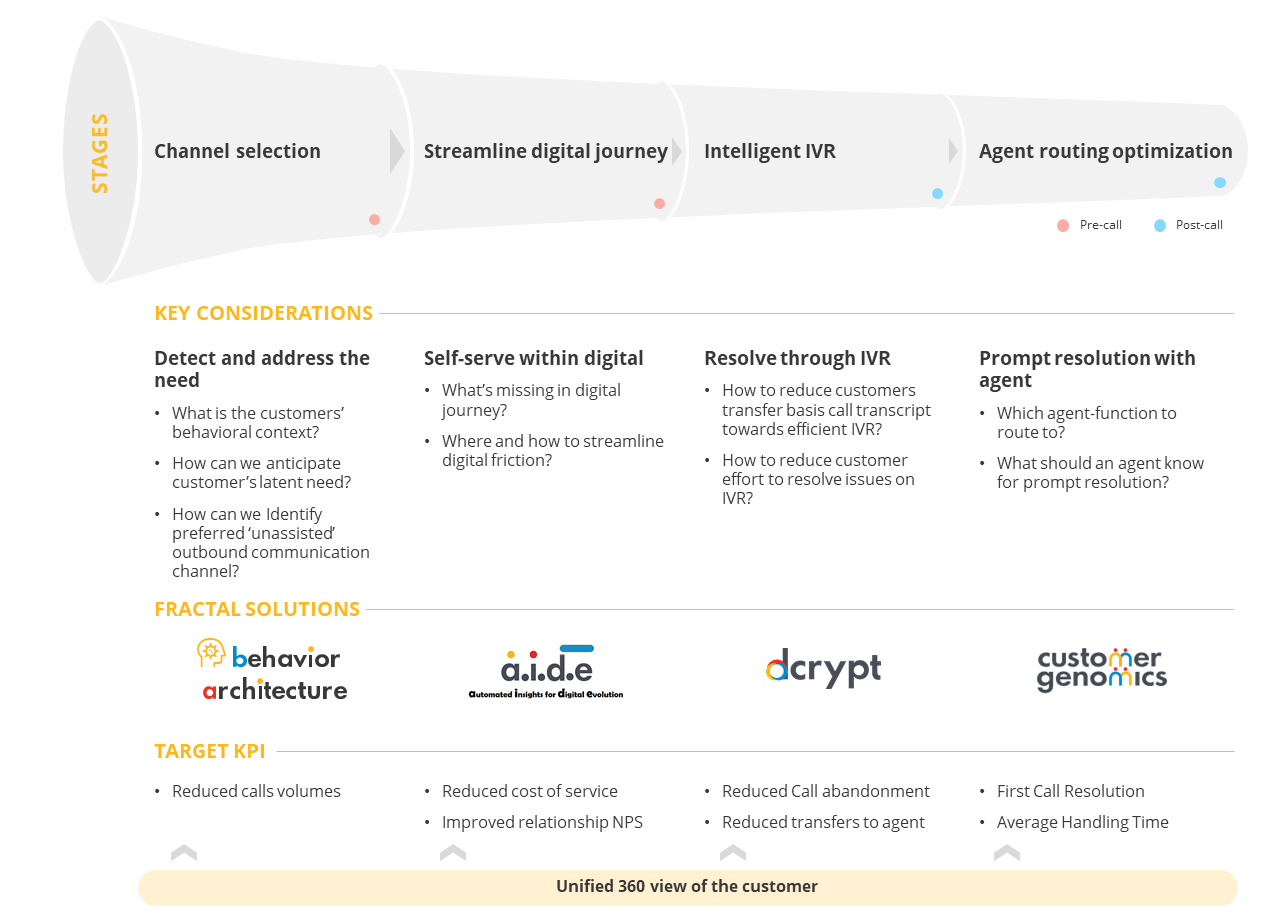

Fractal has developed an integrated solution enabled by AI accelerators that turbocharge the contact-centre team’s throughput. We integrate Data Science, Cognitive Neuroscience, Behavioral Economics and Non-Conscious Design to explain and influence consumer decision making.

- Channel selection: By applying Behavioural sciences, Cognitive Neuroscience, Behavioural Economics, and Non-Conscious Design, we nudge customer cohorts into the self-serve digital channel. Working with a Fortune-100 US credit lender we achieved 7% higher delinquency resolution by driving improved pre-emptive auto-pay enrolment

- Digital journey: AIDE is Fractal’s proprietary AI-based accelerator which analyses friction across numerous digital journeys to identify undiscovered customer pain points and streamline the digital experience. AIDE increased the successful completion of digital journeys. In a recent deployment, it resulted in a 16% drop in call-in rates to phone banking.

- Intelligent IVR: dCrypt uses NLP based voice, and text mining techniques to feedback design inputs for efficient routing design of IVR ‘flow’ towards Virtual-Agent assisted or in-person resolution. Fortune-50 US Insurance firm achieved an 11% reduction in average handling time (AHT) using continuous feedback-learning of IVR Virtual assistant by leveraging unstructured call-logs mining techniques.

- Prompt resolution with Agent: Customer Genomics is a Deep-learning based personalization platform. It provides a holistic view of customer’s transaction and omnichannel interactions to give the agents the Next best Action for customers & conversation-nuggets for prompt redress/remedy. Leading financial services firm improved their NPS by 8% due to better CX with agents leveraging CG’s call-intent prediction & respective conversation-nuggets to personalize conversations.

Authors